More than Just a Builder

Get comprehensive education on business planning, access to planning experts and a funding platform that has successfully raised over $500 million for startups..

George chris

Business plan Analyst

Egbinola Oluwakemi

Technology Analyst/ Software Developer

Britney Mcgregor

Chartered Accountant

What we offers

Learn more about our services

Business Plan. business proposal..

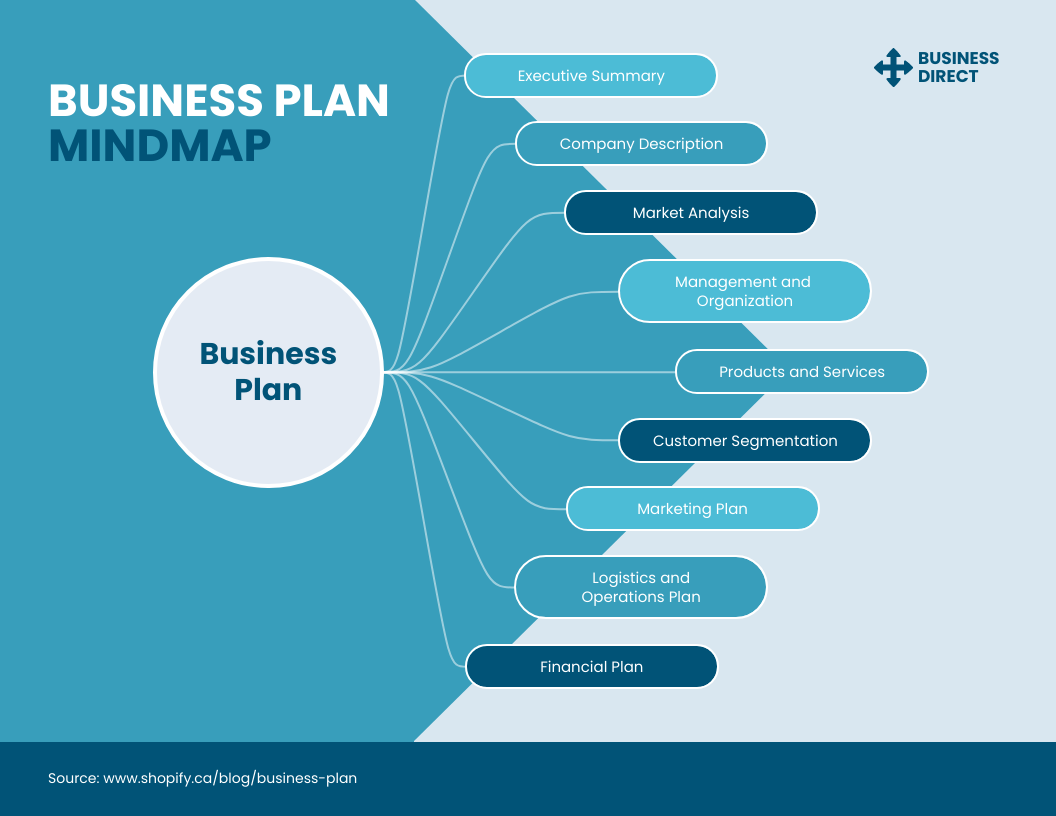

A business plan is a comprehensive document that outlines the goals, strategies, operations, and financial projections of a new or existing business. It typically includes a description of the business, its products or services, target market, marketing and sales strategies, management and organizational structure, financial projections, funding requirements, and risks and challenges.

A well-written business plan serves as a roadmap for the business, guiding its growth and development over time. It is often used to secure funding from investors, lenders, or other sources, and to communicate the vision and objectives of the business to stakeholders such as employees, partners, and customers.

A business plan typically includes the following content:

Executive summary: A brief overview of the business plan, highlighting the key points and goals.

Business description: A detailed description of the business, including its industry, products or services, target market, and unique selling proposition.

Market analysis: A comprehensive analysis of the industry and market in which the business operates, including market size, trends, competition, and customer needs.

Business Registration

Registering your business is an important step in establishing your business's legitimacy, protecting your business, and positioning your business for growth and success.

Legitimacy: Registering your business gives your business legal status and makes it legitimate. This is important because it protects your business from legal issues, including lawsuits.

Branding: Registering your business allows you to brand your business and establish its identity. This helps your business stand out and makes it easier for customers to identify your business.

Permits and Licenses: Depending on the type of business you have, you may need permits and licenses to operate legally. Registering your business can help you obtain the necessary permits and licenses you need to operate.

Tax Purposes: Registering your business is important for tax purposes. When you register your business, you are assigned a tax identification number, which is required for filing taxes.

Access to Funding: Registering your business can help you access funding, such as loans or grants. Many funding sources require businesses to be registered before they can apply for funding.

Credibility: Registering your business can help establish credibility with potential customers, partners, and suppliers. It shows that your business is serious and committed to its operations.

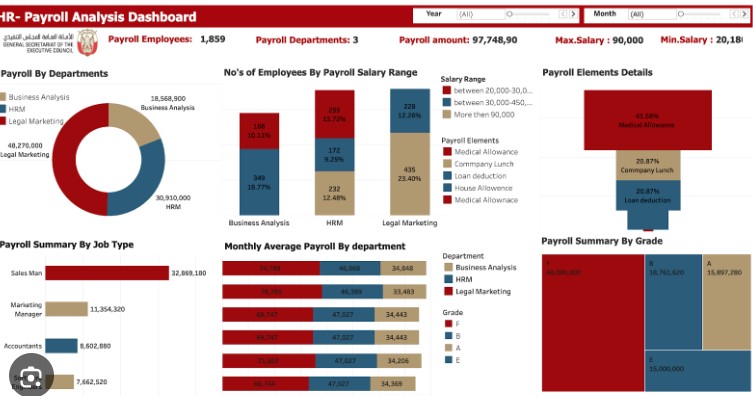

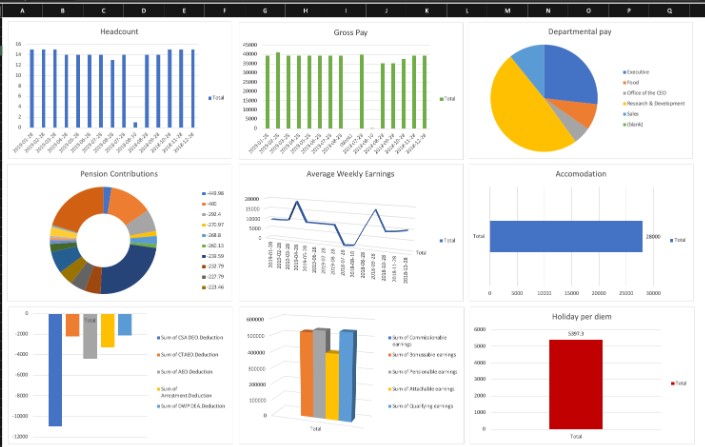

Payroll analysis

Payroll analysis refers to the process of examining and evaluating payroll data to gain insights into an organization's payroll expenses and related costs. This analysis involves a review of the financial information related to payroll, such as employee compensation, benefits, taxes, and other related costs.

Payroll analysis may be used to identify trends, patterns, and discrepancies in payroll data, such as changes in labor costs over time, variations in employee salaries or benefits across departments, or discrepancies in overtime pay. This information can then be used to make informed decisions regarding budgeting, compensation structures, and overall business strategy.

Overall, payroll analysis is a critical tool for businesses and organizations looking to manage their payroll expenses effectively and make informed decisions regarding compensation and benefits.

We’ll also file the corresponding payroll tax forms on your behalf. That includes W-2s, 1099s, Form 940, and more.

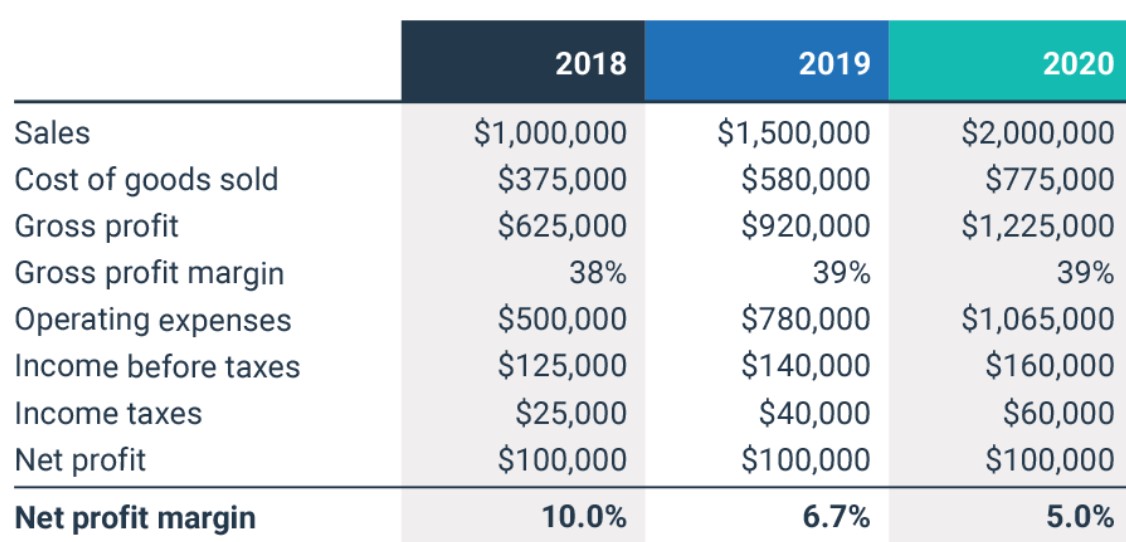

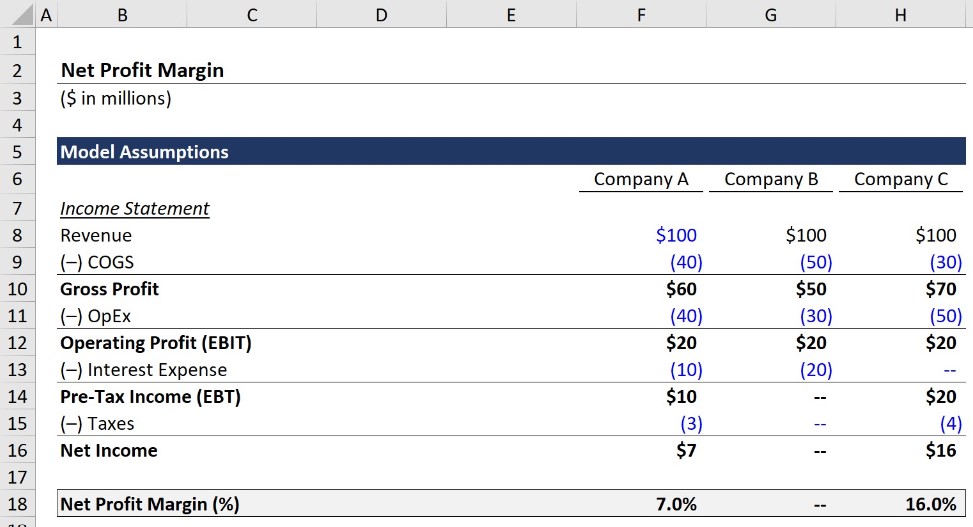

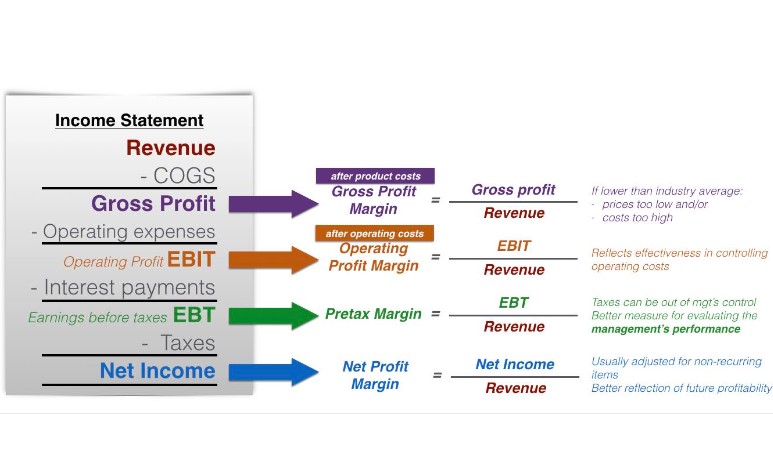

Financial analysis (Formation excel dashboard)

Financial analysis is the process of evaluating a company's financial performance and position by examining its financial statements, ratios, and other financial data.

several reasons why financial analysis is important in business, some of which include:

Assessing performance: Financial analysis helps to evaluate the performance of a company over a period of time. It allows stakeholders to understand the company's financial position, profitability, liquidity, and solvency.

Making investment decisions: Financial analysis provides critical information to investors, such as earnings potential, financial risk, and future growth prospects, which can inform investment decisions.

Budgeting and forecasting: Financial analysis helps businesses to create budgets and forecast future financial performance. It allows companies to anticipate potential financial risks and opportunities, and plan accordingly.

Website Formation

Building a website for your business can be an effective way to reach more customers, increase sales, and build a stronger online presence.

Increased Visibility: A website allows your business to be visible to a larger audience beyond your physical location. It enables potential customers to find and learn about your business, products or services online, and can increase your reach.

24/7 Availability: A website is accessible 24/7, allowing customers to learn about your business and make purchases at any time, even outside of regular business hours.

Improved Credibility: A professional website can improve the credibility and legitimacy of your business. It helps establish trust with potential customers and can differentiate your business from competitors.

Cost-Effective Marketing: A website is a cost-effective way to market your business. You can use it to promote your products or services, offer discounts or promotions, and keep customers informed about your business.

Enhanced Customer Engagement: A website provides an opportunity for customer engagement through features like contact forms, live chat, and social media integration. It can help build relationships with customers and increase customer loyalty.

Business Formation

Business formation process can be complex and it's important to seek professional advice from an attorney or accountant before making any decisions.

Business formation refers to the process of legally creating a new business entity, such as a corporation, limited liability company (LLC), partnership, or sole proprietorship. The process typically involves filing legal documents with the state government where the business is located and obtaining necessary permits, licenses, and tax identification numbers.

The type of business formation chosen can have important legal and financial implications for the business owner, including liability protection, tax treatment, and management structure. Each type of business formation has its own advantages and disadvantages, and the choice will depend on various factors such as the size of the business, number of owners, and the level of personal liability protection desired.

Market Research

Market research is essential for businesses of all sizes, and there are several reasons why it's important:

Understanding Customer Needs: Market research helps businesses understand their target audience and their needs, preferences, and behaviors. It allows businesses to tailor their products, services, and marketing efforts to meet customer needs.

Identifying Opportunities: Market research can help businesses identify new opportunities, such as emerging trends, new market segments, or gaps in the market. It can also help businesses understand the competitive landscape and identify areas where they can differentiate themselves from competitors.

Risk Mitigation: Market research can help businesses minimize risks by identifying potential challenges or threats in the market. It can help businesses make informed decisions about product development, marketing, and expansion.

Strategic Planning: Market research provides businesses with valuable data that can inform strategic planning. It can help businesses set realistic goals, develop effective marketing strategies, and make informed decisions about resource allocation.

Measuring Success: Market research can help businesses track their performance and measure the success of their marketing efforts. It provides valuable insights into customer satisfaction, brand awareness, and customer loyalty, allowing businesses to make data-driven decisions about how to improve their performance.

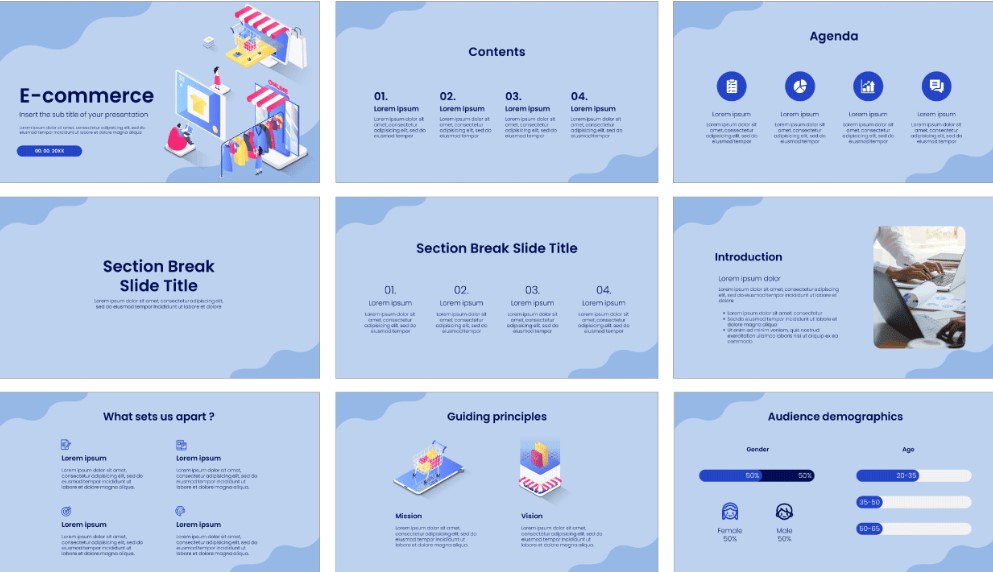

Powerpoint Slide

PowerPoint slides are a valuable tool for creating effective and engaging presentations. They help to organize information, enhance communication, and make your presentation more visually appealing and memorable.

Visual Aid: PowerPoint slides provide a visual aid to support your presentation. They help to convey information in a clear and concise way and can make your presentation more engaging and memorable for the audience.

Organization: PowerPoint slides allow you to organize your presentation into sections, making it easier for you to stay on track and ensure that all important points are covered.

Flexibility: PowerPoint slides are highly customizable, allowing you to incorporate images, charts, graphs, and other visual elements to enhance your presentation. They can also be easily edited and updated as needed.

Time Management: PowerPoint slides can help you manage your time during a presentation by keeping you on track and ensuring that you cover all important points within the allotted time.

Professionalism: PowerPoint slides can give your presentation a professional look and feel, making you appear more polished and prepared to your audience.

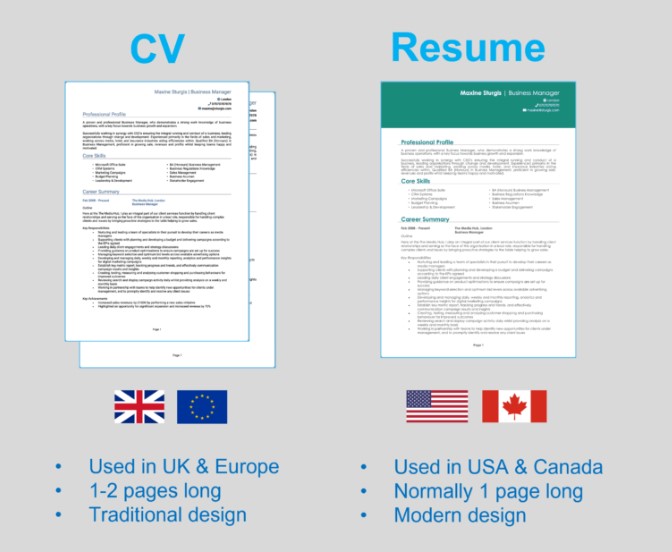

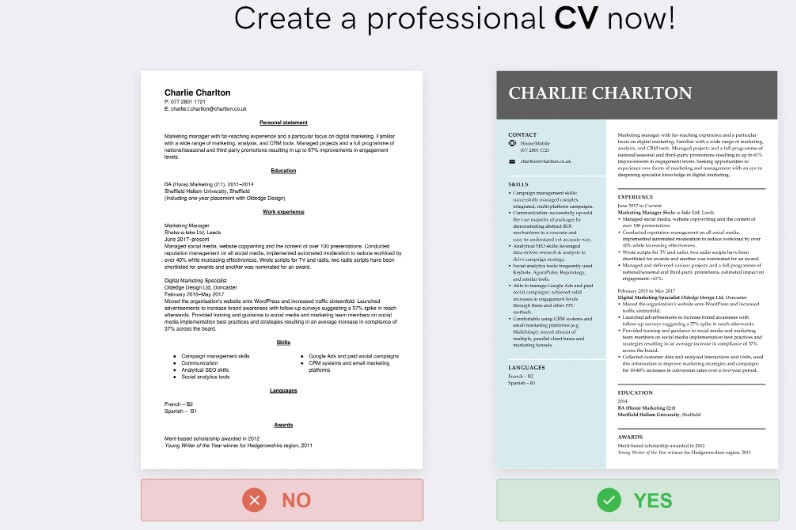

Curriculum Vitae vs. Resume: Format and Content

The CV presents a full history of your academic credentials, so the length of the document is variable. In contrast, a resume presents a concise picture of your skills and qualifications for a specific position, so length tends to be shorter and dictated by years of experience (generally 1-2 pages).

CVs are used by individuals seeking fellowships, grants, postdoctoral positions, and teaching/research positions in postsecondary institutions or high-level research positions in industry. Graduate school applications typically request a CV, but in general are looking for a resume that includes any publications and descriptions of research projects.

Resume

Emphasize skills

Used when applying for a position in industry, non-profit, and public sector

Is no longer than 2 pages, with an additional page for publications and/or poster presentations if highly relevant to the job After 1 year of industry experience, lead with work experience and place education section at the or near the end, depending upon qualifications

CV

Emphasizes academic accomplishments

used when applying for positions in academia, fellowships and grants

Length depends upon experience and includes a complete list of publications, posters, and presentations

Always begins with education and can include name of advisor and dissertation title or summary (see examples). Also used for merit/tenure review and sabbatical leave

Executive Core Qualifications (ECQs)

Executive Core Qualifications (ECQs) are a set of competencies and characteristics that the U.S. Office of Personnel Management (OPM) has identified as essential for top-level federal government positions. ECQs are designed to assess the abilities of candidates for senior leadership positions in the federal government.

There are five ECQs that OPM has identified as critical for executive success:

Leading Change

Leading People

Results Driven

Business Acumen

Building Coalitions

Each of these core qualifications includes specific competencies and behaviors that candidates must demonstrate in order to be considered for a senior leadership position in the federal government. ECQs are used by federal agencies to evaluate candidates for Senior Executive Service (SES) positions, which are the highest-ranking career positions in the federal government.